One, Big, Beautiful Bill Act Provisions

The One, Big, Beautiful Bill Act significantly affects federal taxes, credits and deductions. It was signed into law on July 4, 2025, as Public Law 119-21, and takes effect in 2025. Below is an overview of some important tax changes brought on by the One, Big, Beautiful Bill Act. For a complete list of all major provisions, please click here.

Increase use of Electronic Payments

· Paper refund checks are being eliminated. The IRS began phasing out paper refund checks for individual taxpayers on September 30, 2025. o IMPORTANT: If you choose to request a tax refund without direct deposit information, your refund can be delayed up to an additional 6 weeks.

· While there are no current changes to payment methods, refunds are moving to electronic delivery, and a shift to mandatory electronic payments is likely to happen in the near future.

Deduction for Seniors

Overview of the deduction

· Effective 2025 through 2028, individuals age 65 and older may claim an additional $6,000 deduction.

· This is in addition to the standard deduction.

· Phases out for taxpayers with modified adjusted gross income over $75,000 ($150,000 for joint filers)

No Tax on Tips

Overview of the deduction

· Effective 2025 through 2028, employees and self-employed individuals may deduct qualified tips they received in occupations the IRS identified as “customarily and regularly receiving tips” on or before December 31, 2024, and are reported on a Form W-2, Form 1099, another statement furnished to the individual, or on Form 4137 if the individual directly reports the tips.

· “Qualified tips” include voluntary cash or charged tips received from customers, including shared tips.

· Maximum annual deduction is $25,000.

· Phases out for taxpayers with modified adjusted gross income over $150,000 ($300,000 for joint filers).

No Tax on Overtime

Overview of the deduction

· Effective 2025 through 2028, individuals may deduct the portion of qualified overtime pay that exceeds their regular rate of pay (for example, the “half” portion of “time-and-a-half”).

· Overtime must be reported on Form W-2, Form 1099, another statement furnished to the individual, or directly by the individual.

· Maximum annual deduction is $12,500 ($25,000 for joint filers).

· Phases out for taxpayers with modified adjusted gross income over $150,000 ($300,000 for joint filers).

No Tax on Car Loan Interest

Overview of the new deduction

· Effective 2025 through 2028, individuals may deduct interest paid on a loan used to purchase a qualified vehicle for personal use that meets other eligibility criteria. Lease payments do not qualify.

· Maximum annual deduction is $10,000.

· Phases out for taxpayers with modified adjusted gross income over $100,000 ($200,000 for joint filers).

What counts as qualified interest

Interest must be paid on a loan that:

· Originated after December 31, 2024

· Was used to purchase a vehicle originally owned by the taxpayer

· Was secured by a lien on the vehicle

· Was for a personal-use (nonbusiness) vehicle

If a qualifying vehicle loan is later refinanced, interest paid on the refinanced amount is generally eligible for the deduction.

What counts as a qualified vehicle

A qualified vehicle is a car, minivan, van, SUV, pickup truck or motorcycle that:

· Has a gross vehicle weight rating of less than 14,000 pounds

· Underwent final assembly in the United States.

· You must include the VIN on your return for any year you claim the deduction.

To verify final assembly, check one of these:

· The vehicle label at the dealership

· The vehicle identification number (VIN)

· The National Highway Traffic Safety Administration, NHTSA VIN Decoder (verify vehicle assembly location)

For more in-depth information on these individual tax updates mentioned above, please click here.

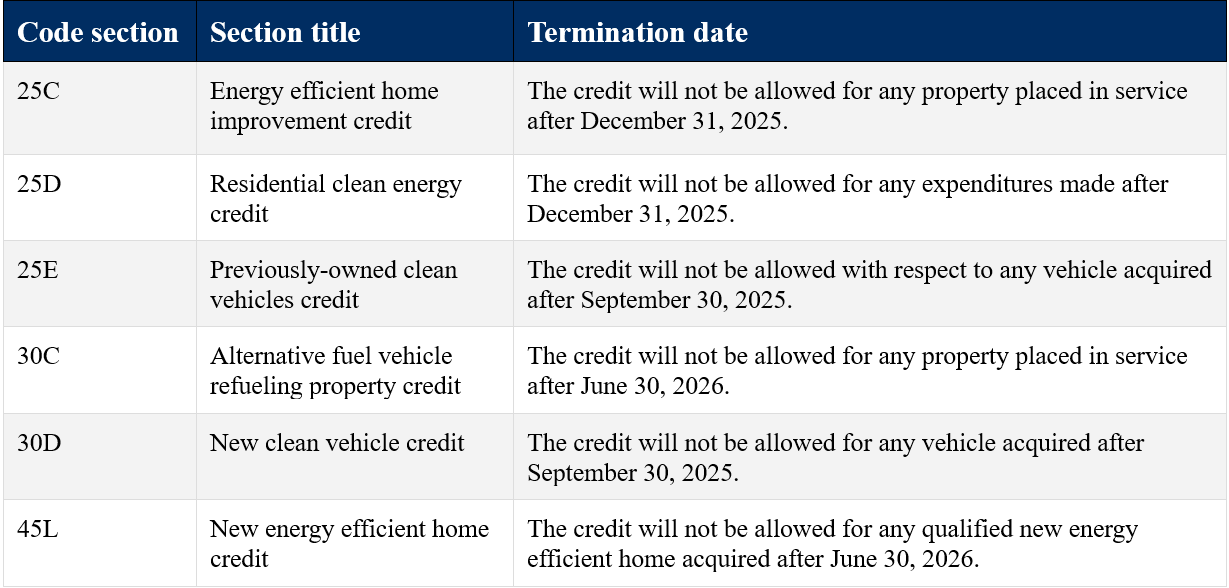

Clean Energy Credit Phaseouts

The Act accelerates the end of several clean vehicle credits as well as home and residential energy credits.

For more information about these credits and their expiration dates, please click here.